Basics of Accounting for Online Startups

Awareness of your online startup's financial statements is important

09/06/2023

When you launch an online startup, it is possible to get caught up in the race to success. You may focus all of your efforts on promoting your products and services. But the accounting needs of your business might also require your attention. Overlooking this aspect may create significant problems for your venture in the future.

As a small-and-medium-sized business owner, awareness of your venture’s financial statements is of utmost importance. It is wise to know how your money was spent or used, how much profit you have gained, and what changes need to be done to ensure continued success. In most cases, the answers to these questions can help you effectively run and grow your business.

Irrespective of your business size, maintaining a balance sheet of financial transactions is part of being an entrepreneur. Online startups that build a strong accounting foundation are likely to control expenses; stay organized, secure financing, boost efficiency, and recognize potential risks and opportunities for the business.

If you want to learn more about business accounting and types of accounting, read on!

As a small-and-medium-sized business owner, awareness of your venture’s financial statements is of utmost importance. It is wise to know how your money was spent or used, how much profit you have gained, and what changes need to be done to ensure continued success. In most cases, the answers to these questions can help you effectively run and grow your business.

Irrespective of your business size, maintaining a balance sheet of financial transactions is part of being an entrepreneur. Online startups that build a strong accounting foundation are likely to control expenses; stay organized, secure financing, boost efficiency, and recognize potential risks and opportunities for the business.

If you want to learn more about business accounting and types of accounting, read on!

What is accounting?

For every business, effective accounting practices, intelligent budget management and modifying financial strategies as and when required serve as the key drivers of success. But to enable these success drivers, you need to understand what accounting is.

Accounting can be a useful way of tracking and summarizing the financial transactions of a business. In fact, it may be considered an essential tool for decision making, cost planning, and measuring your business’ performance.

An accounting process ordinarily involves recording and organizing your company’s incomes and expenditures. It allows you to understand your past financial activities and evaluate how your business is performing financially.

Proper accounting strategies can help you remain compliant with different statutory regulations, especially relating to taxation. They can also help you create budget and future projections, and provide a basis for important managerial decisions. Furthermore, you can use your financial statements and data to attract new investment opportunities.

It is advisable for a small business and startup owner to open a separate bank account for your business. By doing this, you can separate your business accounts from personal finances. Regularly tracking your business expenses including bills, proof-of-payments, receipts, invoices, financial statements and tax returns may also help you understand where your finances are being used.

Accounting can be a useful way of tracking and summarizing the financial transactions of a business. In fact, it may be considered an essential tool for decision making, cost planning, and measuring your business’ performance.

An accounting process ordinarily involves recording and organizing your company’s incomes and expenditures. It allows you to understand your past financial activities and evaluate how your business is performing financially.

Proper accounting strategies can help you remain compliant with different statutory regulations, especially relating to taxation. They can also help you create budget and future projections, and provide a basis for important managerial decisions. Furthermore, you can use your financial statements and data to attract new investment opportunities.

It is advisable for a small business and startup owner to open a separate bank account for your business. By doing this, you can separate your business accounts from personal finances. Regularly tracking your business expenses including bills, proof-of-payments, receipts, invoices, financial statements and tax returns may also help you understand where your finances are being used.

Types of accounting methods:

The following accounting methods are designed to record income and expenses to help you calculate your profit for a specific time-period.

Cash Method

Under the cash basis of accounting, income and expenses are recorded when they are actually received or paid. For example, a sale is recorded only when your business receives the payment and an expense is recorded only when your business pays a bill. This is one of the most common and simplest forms of accounting. It is usually used by small businesses and professionals to maintain their accounting books.

Accrual Method

Under this method, income and expenses are recognized when the transaction occurs rather than when they are received or paid. For example, purchase orders are recorded as incomes even when the money is not received immediately and expenses are recorded as expenditures although no payments have been made. Most accountants and businesses use the accrual method of accounting since it can show the actual profit gained or loss incurred during a specific time. In fact, this method is the industrial standard for IFRS and GAAP accounting.

Hybrid Method

This method is a combination of cash-based and accrual-based methods of accounting. It can also include other special methods of accounting. The hybrid accounting method is acceptable for both internal accounting and tax purposes. You may use any combination of accounting methods as long as they are consistently used and clearly reflect your business income and expenditure.

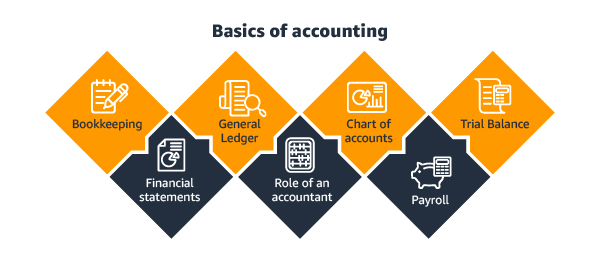

Good accounting often starts with knowing the basics

Your job does not end at selecting an accounting method. You may also need to be familiar with some of the basic accounting concepts and terminology.

Bookkeeping:

It is the process of recording and classifying all of your financial transactions. You can either learn operating bookkeeping softwares or simply use a spreadsheet. Hiring a part-time accountant or an in-house bookkeeper and/or accountant to fulfill your bookkeeping needs is also a widely used option.

General Ledger:

It is a document used by the bookkeeper or accountant to record your income and expenses. The general ledger holds information such as date of each transaction, credit and debit amounts, names and/or account numbers where the amount needs to be credited or debited, and a description of every entry.

Chart of accounts:

It is a list of all the financial accounts in your general ledger. A chart of accounts helps you classify your accounts as income, assets, expenses and liabilities.

Trial Balance:

A trial balance is a worksheet that helps to ensure that all records in your bookkeeping ledger are mathematically correct. It has two columns, one for credits and one for debits. In a balanced trial balance, total debits are equal to total credits.

Financial statements:

These are formal reports that highlight the financial performance of your business. There are three main types of financial statements:

- Income statement: This report shows how profitable your business was during an accounting period. Also known as a profit and loss statement, this statement shows revenue earned and expenses incurred.

- Balance Sheet: This financial statement provides details about your business assets, liabilities, and shareholders' equity. It reflects your business’ actual net worth during a particular period.

- Cash-flow statement: It tells you how much cash was generated and paid out over a given period. A cash-flow statement can potentially help you predict future cash shortages or surpluses.

Role of accountant:

You can hire an accountant to take care of your accounting needs. Accountants review your bookkeeping ledger, prepare financial statements and reports, and prepare your tax filings.

Payroll

When you plan to hire part-time or full-time employees, you may need to correctly calculate and track payroll. This includes everything from maintaining employee time records to handling employee personnel records to making timely payroll payments. You can hire a payroll department if you have more employees.

Simplify your accounting system with digital solutions

You can choose to simplify the accounting process of your business by integrating digital solutions into your accounting system.

In fact, there are many solutions in the market that are specifically designed to efficiently manage your company’s accounts and ease an accountant’s work. New digital accounting technologies can help you fulfill the need for real-time collection and reporting of all financial transactions and ensure easier filing of tax returns. They also speed up the process of making financial forecasts.

According to a report, the use of digital solutions in accounting is growing as more businesses are prioritizing paperless accounting. Many companies believe that accounting digitalization can improve data quality and data consistency.

The global accounting services market is estimated to reach USD 687.7 billion in 2023. This market is projected to grow at a CAGR of 6.09% between 2020 and 2023.

You can use high-end software applications to manage your accounting needs.

According to a report, the use of digital solutions in accounting is growing as more businesses are prioritizing paperless accounting. Many companies believe that accounting digitalization can improve data quality and data consistency.

The global accounting services market is estimated to reach USD 687.7 billion in 2023. This market is projected to grow at a CAGR of 6.09% between 2020 and 2023.

You can use high-end software applications to manage your accounting needs.

Conclusion

Having an organized and efficient accounting system can help you improve your business performance. Remember, you can have better control over your finances by properly managing your accounts.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Latest Articles

Become a Seller today

Put your products in front of the crores of customers on Amazon every day.

It takes only 15 minutes to setup your account