What is EPF registration for employers?

The Employees Provident Fund or EPF scheme lets you provide retirement benefits to your employees. The EPF was introduced as a provision under the Employees’ Provident Funds and Miscellaneous Provisions Act of 1952 and is monitored and controlled by, Employees’ Provident Fund Organization (EPFO), a government organization, which is also the World’s largest Social Security Organization.

EPF eligibility criteria

You will need to register for EPF if:

- Your establishment is a factory that is engaged in any industry and provides employment to 20 or more working persons.

- Your company employs 20 or more persons.

- Your company has been instructed by the government to undergo EPF registration.

Once you reach an employee strength of 20, you will need to complete the EPF registration within 30 days. Failing to do this could lead to penalties. Once you have registered, you will be required to provide EPF benefits even if you reduce the number of employees below 20.

Besides achieving minimum employee strength there are other ways that can make EPF registration necessary. For instance, even if your employee count is less than 20, the central government can ask you to register with a minimum of 2 months’ notice.

Moreover, in case you and a majority of your employees mutually agree to register for EPF, you can make an application to the Central PF (Provident Fund) Commissioner. After the Central PF Commissioner receives the application, you can go ahead with the registration of your organization. This is done once a notification is passed in the Official Gazette from the date of such agreement or from any other date specified in the agreement.

Although not compulsory, companies with an employee count less than 20 can also voluntarily obtain PF registration. In this case, an EPF registration automatically makes all employees eligible for EPF benefits once their employment commences. It is then the sole responsibility of the employer to make deduction & payment of PF.

The PF contribution of 12% needs to be divided equally between you and your employees. The employer’s contribution is 12% of basic salary. The PF deduction rate is 10% for the companies that have less than 20 employees.

Besides achieving minimum employee strength there are other ways that can make EPF registration necessary. For instance, even if your employee count is less than 20, the central government can ask you to register with a minimum of 2 months’ notice.

Moreover, in case you and a majority of your employees mutually agree to register for EPF, you can make an application to the Central PF (Provident Fund) Commissioner. After the Central PF Commissioner receives the application, you can go ahead with the registration of your organization. This is done once a notification is passed in the Official Gazette from the date of such agreement or from any other date specified in the agreement.

Although not compulsory, companies with an employee count less than 20 can also voluntarily obtain PF registration. In this case, an EPF registration automatically makes all employees eligible for EPF benefits once their employment commences. It is then the sole responsibility of the employer to make deduction & payment of PF.

The PF contribution of 12% needs to be divided equally between you and your employees. The employer’s contribution is 12% of basic salary. The PF deduction rate is 10% for the companies that have less than 20 employees.

Steps for EPF registration

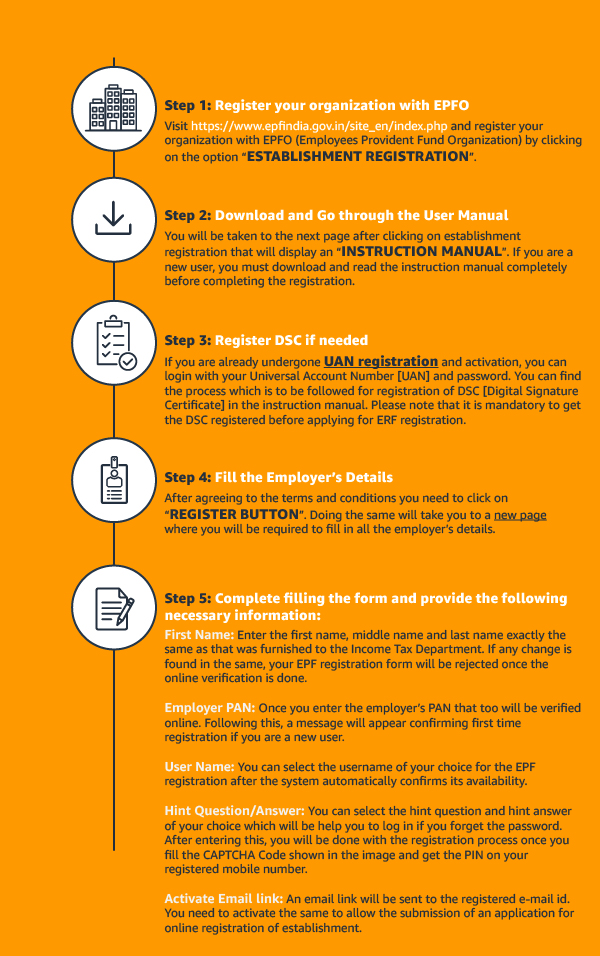

You can easily apply for EPF registration by following the below mentioned steps:

- Step 1- Register your organization with EPFO

Visit the official EPF website and register your organization with the EPFO (Employees Provident Fund Organization). Clicking on the option “ESTABLISHMENT REGISTRATION” to proceed. - Step 2: Download and Go through the User Manual

You will be taken to the next page that will display an “INSTRUCTION MANUAL”. If you are a new user, you must download and read the instruction manual completely before completing the registration. - Step 3: Register DSC if needed

If you have already completed your Universal Account Number [UAN] registration and activation, you can use your UAN and password to login. But before you can proceed with the EPF registration, you will need to get your digital signature certificate (DSC) registered. You can find the process which is to be followed for registration of DSC in the instruction manual. - Step 4: Fill the Employer’s Details

After agreeing to the terms and conditions you need to click on “REGISTER BUTTON”. Doing the same will take you to a new page where you will be required to fill in all the employer details. - Step 5: Complete filling the form and provide the following necessary information:

- First Name: Enter the first name, middle name and last name exactly the same as that was furnished to the Income Tax Department. If any discrepancy is found in the same, your EPF registration form will be rejected during the online verification.

- Employer PAN: Once you enter the employer’s PAN that too will be verified online. Following this, a message will appear confirming first time registration if you are a new user.

- User Name: You can select the username of your choice for the EPF registration after the system automatically confirms its availability.

- Hint Question/Answer: You can select the hint question and hint answer of your choice which will help you to log in if you forget the password. After entering this, you will be done with the registration process once you fill the CAPTCHA Code shown in the image and get the PIN on your registered mobile number.

- Activate Email link: An email link will be sent to the registered email id. You need to activate the same to allow the submission of an application for online registration of establishment.

Details required for online EPF registration process for employer

The online registration process is quite simple. However, you will need to provide the following details:

- Company details:

- Your company’s name

- Registered address of your company

- Date of incorporation of your company

- Your company’s Permanent Account Number (PAN)

- Type of your company

- If your establishment is a factory, you will need to provide following details:

- The license number of your Factory

- Date of issue of your license

- Place of issue of your license

- If your establishment is a micro, small or medium enterprise (MSME) then you would need to submit the MSME registration details.

- Details of e-contact of authorized person: You need to provide the email address and mobile number of the authorized person.

- Details of any contact Person: Besides e-contact of an authorized person, employers must provide details of another person from the establishment that can be contacted (for example the manager). The following details must be submitted about the contact person:

- Name of the person

- Date of Birth

- Gender

- Contact details (email address, contact number and residential address) - Your license information or identifiers: The license information that the employer needs to provide for registration are called identifiers.

- Details of employment:

- Total number of employees working in the establishment

- Gender of the employees

- Type of activities that the employees are engaged in

- Wages above limit

- Total wages of the employees

- Branch/Division details: Details about branch or division including name, premise number, and address of the establishment

- Activities of the establishment: From the drop down lists available on the EPF registration page, the employer needs to select the type of business and its activities.

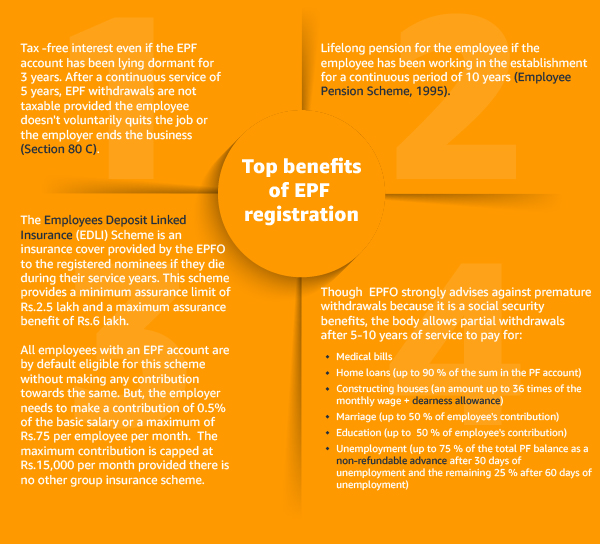

Top benefits of EPF registration

- You get tax-free interests even if your EPF account has been lying dormant for 3 years. After a continuous service of 5 years, EPF withdrawals are not taxable provided the employee doesn't voluntarily quit the job or the employer ends the business (Section 80 C).

- Lifelong pension for the employee if the employee has been working in the establishment for a continuous period of 10 years (Employee Pension Scheme, 1995).

- The Employees Deposit Linked Insurance (EDLI) Scheme provides insurance cover to the nominees if a registered employee dies during their service years. This scheme provides a minimum assurance limit of Rs. 2.5 lakh and a maximum assurance benefit of Rs. 6 lakh.

All employees with an EPF account are by default eligible for this scheme without making any contribution towards the same. But, the employer needs to make a contribution of 0.5% of the basic salary or a maximum of Rs. 75 per employee per month. The maximum contribution is capped at Rs. 15,000 per month provided there is no other group insurance scheme. - Though EPFO strongly advises against premature withdrawals because it is a social security benefits, the body allows partial withdrawals after 5-10 years of service to pay for:

- Medical bills

- Home loans (up to 90% of the sum in the PF account)

- Constructing houses (up to 36 times of the monthly wage + dearness allowance)

- Marriage (up to 50% of employee's contribution)

- Education (up to 50% of employee's contribution)

- Unemployment (up to 75% of the total PF balance as a non-refundable advance after 30 days of unemployment and the remaining 25 % after 60 days of unemployment)

Conclusion

The present EPF interest rate stands at 8.33%. If leveraged in terms of returns from a debt, the benefits of EPF registration for employers and employees can be significant. EPF comes under sovereign-backed financing and the interest earned is not liable for any tax. In fact, it presently enjoys the status of EEE (Exempt, Exempt, Exempt) as contributions are deducted from incomes. It is safe to say that there are no debt products that provide such high returns with safety and assurance as the EPF scheme.

Insert Cat Reusable

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Share the knowledge of Bizzopedia

Article Categories

Amazon Programs for SMBs