2019 was the year of the Indian startups. The country’s startup scene attracted over USD 14.5 billion from global investors.

This comes as especially good news because capital is the most important thing that your company needs to run properly. To start your own business and run it in a competitive world, you need good financial support. But how do you get access to funding and what are the options available for small and medium businesses?

All you need is the right strategy and the know-how. To begin with, here are some tips for getting good Startup business funding.

This comes as especially good news because capital is the most important thing that your company needs to run properly. To start your own business and run it in a competitive world, you need good financial support. But how do you get access to funding and what are the options available for small and medium businesses?

All you need is the right strategy and the know-how. To begin with, here are some tips for getting good Startup business funding.

Why do startups require stable and consistent funding?

Small businesses have to be careful about expenses as they normally don’t have a lot of inherent capital. With the right amount of funding for startups you can prevent certain business problems from happening. These are the advantages you have when you are prepared financially.

- You are aware of how much funds are required.

You can determine the correct funds amount for various business activities. For example, when setting up their business, launching a new product or when entering a new market. - You will find it easier to create scalable business models.

Investors will be ready to invest in your business if they see that it can be scaled easily and guarantees an increase in ROI. You will also have a clear idea on how much funds will be required for seeking loans to expand the business or for acquiring venture capital. - You are better prepared for business failures.

If you have adequate capital backing, you can be prepared to avoid business failures and shortcomings. For example, you can invest to boost sales, launch marketing campaigns, and relaunch a product in new stores.

Assessing the right funds volume for your business

There are so many platforms that can find investors or invest in startups directly. However, it is increasingly important to keep a few things in mind while assessing the financial status of your startup:

- Don’t completely rely on your own personal savings or cash flows. It is your hard-earned cash and not worth the risk! Instead, you can use this to supplement the ROI you receive from sales of your items or services.

- Look around for reputed venture capitalists that specialize in financing startups.

- Since online media is a huge trend, you can try crowdfunding. But make sure you first know all about crowdfunding, how it works and its impact. Keep reading to know more about this.

- The best way to build funds is to sell the product at minimal cost. Let the market see how useful your item is first and wait for sales to increase. When the sales increase, you can reinvest this revenue to build more funds.

Before you begin tackling your funding issues, there are a few other early funding factors that you will need to examine. These include:

- Current business strategy

- Potential market that you are targeting

- Plans for executing your business strategy

- Plans for current and future growth

- Critical funding requirements

The next step is to shortlist the funds sources that are suitable for your business. This is an important stage. As you proceed you will need to target funds sources that:

1) Possess an investment portfolio of the same size.

2) Are focused on your sector.

3) Have a good investment history (primarily because a major part of their available funding comes from these funds).

Once you have shortlisted the right people, you can begin working on your pitch. A pitch is your value proposition and explains why you are asking for funding. During the usual pitch, you will have to talk in detail about why you require investments, various stages in the business that you will need those investments, and the returns.

1) Possess an investment portfolio of the same size.

2) Are focused on your sector.

3) Have a good investment history (primarily because a major part of their available funding comes from these funds).

Once you have shortlisted the right people, you can begin working on your pitch. A pitch is your value proposition and explains why you are asking for funding. During the usual pitch, you will have to talk in detail about why you require investments, various stages in the business that you will need those investments, and the returns.

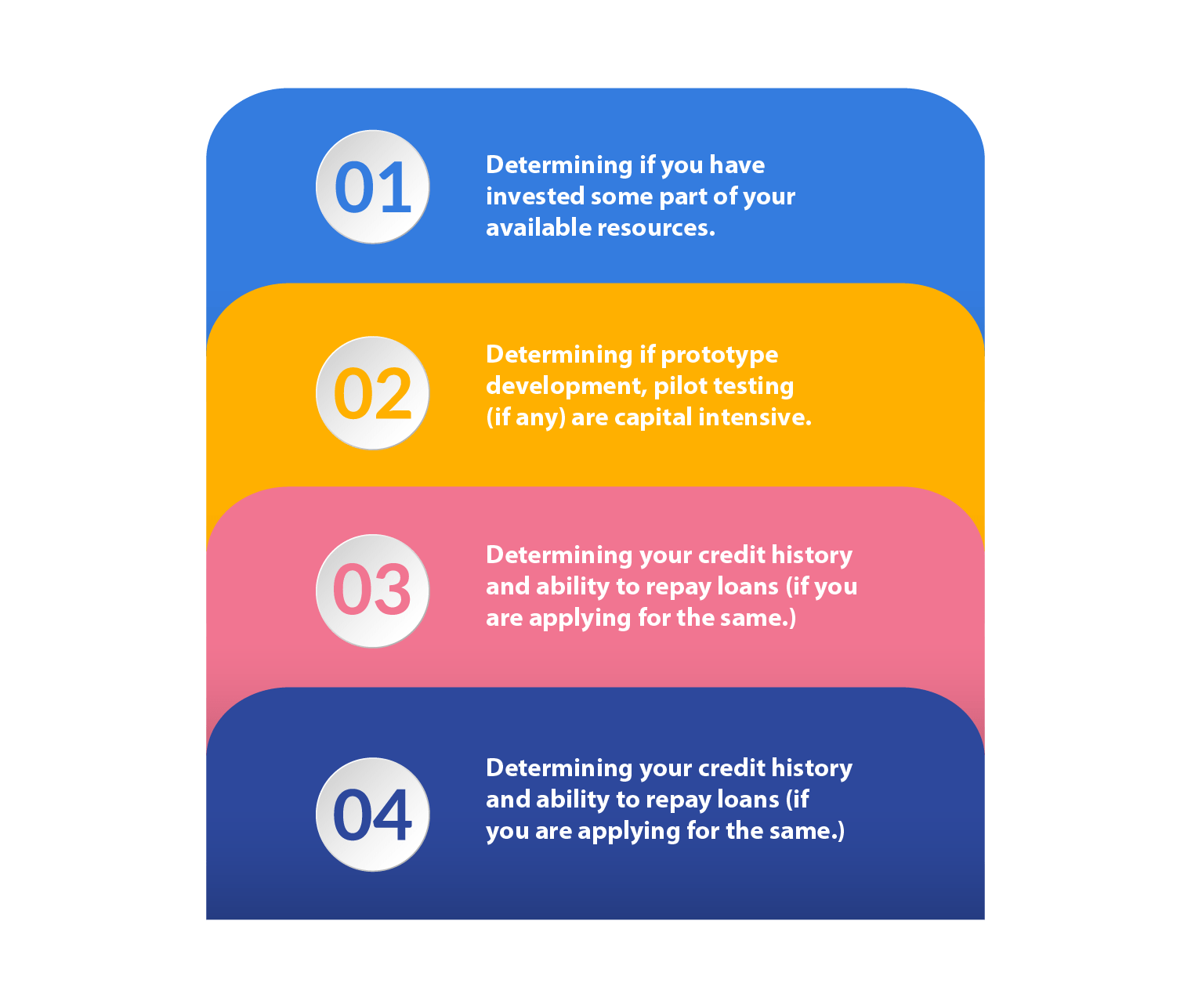

Building trust with interested investors

When it comes to securing investment, you will need to create a strong trust with your investors. This can be done by giving them a clear picture of the future of your business. In other words, investors will test your commitment to the business idea by:

- Determining if you have invested some part of your available resources.

- Determining if prototype development, pilot testing (if any) are capital intensive.

- Determining your credit history and ability to repay loans (if you are applying for the same.)

- Determining the feasibility of your product/venture and ability to generate adequate ROI.

While it is quite acceptable to try to acquire early funding for a small business startup, it often results in limited trust, even if your business strategy is well-planned. This is mainly because of an unclear picture of the risks involved in businesses. One risk is the uncertainty of outcomes of executing your business plan. The other is the risk of dilution in the initial business stages, owing to comparatively lower valuations.

While planning out your pitch and searching for investors, ask mentors for sound advice on running your startup. Create a list of venture capitalists who have invested in similar, small businesses before. Keep everything simple by following these rules:

While planning out your pitch and searching for investors, ask mentors for sound advice on running your startup. Create a list of venture capitalists who have invested in similar, small businesses before. Keep everything simple by following these rules:

- Be 100% certain about your business plan.

- Know what to expect out of different investors.

- Pitch a clear idea to your investors.

Understanding the different startup funding methods

You can always start small, earn some revenue, and slowly grow your business. Or you can try to acquire outside lump sum funding like loans and investments. If you have available credit and assets, you can borrow from banks, but this amount must be repaid. Some startups get extra capital through other methods explained below. However, the availability of these funds is dependent on the following criteria:

- The past track record of the startup

- The progress made so far

- Scalability of the business

- Size of your market

A) Bootstrapping:

In this approach you build a company from scratch relying solely on your personal bank account and initial sales. As a result, you will have minimal or no cash flow from outside. What they do is risk their own money as the venture capital source.

In this approach you build a company from scratch relying solely on your personal bank account and initial sales. As a result, you will have minimal or no cash flow from outside. What they do is risk their own money as the venture capital source.

Plus Points

Minus Points

Entrepreneurs can maintain total control over decision making business.

Tough process with high financial risk.

Quick way to turn profits.

Limited resources may prevent growth, promotions, and product quality.

Business owners can experiment with their brand.

No backing from reputed investors results in poor brand credibility.

B) Financial aid from your own business/personal contacts

This option might be suited to you if you are looking to raise funds at initial stages from people close to you. This could include your local community, family, friends, and close colleagues.

Also present them with a clear business plan that explains products, rates, ROI, and repaying their investments.

This option might be suited to you if you are looking to raise funds at initial stages from people close to you. This could include your local community, family, friends, and close colleagues.

Also present them with a clear business plan that explains products, rates, ROI, and repaying their investments.

Plus Points

Minus Points

Easy access to funds.

Legal disputes in case your product/service is successful.

Faster way to get your venture started.

Investors can back out at any time.

Limited financial risk.

Investors may demand full immediate repayment.

C) Crowdfunding

Crowdfunding occurs when businesses rely on the masses to invest in a business or ask for funds directly from the public using an online platform. It works via organizations, individuals who choose to invest in various crowdfunding projects. In return, they receive potential rewards, profits or a share of the turnover. Some examples include Oculus Rift, Pebble Watch.

Crowdfunding occurs when businesses rely on the masses to invest in a business or ask for funds directly from the public using an online platform. It works via organizations, individuals who choose to invest in various crowdfunding projects. In return, they receive potential rewards, profits or a share of the turnover. Some examples include Oculus Rift, Pebble Watch.

Plus Points

Minus Points

You can raise a lot of funds.

This investment can be risky. Learn all about crowdfunding platforms for startups before you begin.

It’s a great way to build and test the market.

Spend time and effort finding interested investors.

It can accelerate your business and networking chances.

May result in false positives because the product wasn’t well promoted.

D) Angel investors

Angel investors is another term for private investors. These are individuals with high net worth and capable of providing financial support in exchange for ownership equity in your company. They provide either a one-time investment to start up a venture or inject capital throughout the business lifespan to support tough early stages.

Angel investors is another term for private investors. These are individuals with high net worth and capable of providing financial support in exchange for ownership equity in your company. They provide either a one-time investment to start up a venture or inject capital throughout the business lifespan to support tough early stages.

Plus Points

Minus Points

It’s a form of equity investing that’s less risky than debt financing

You lose complete control as angel investors want part ownership.

No repayment of invested capital in case of business failure

Has control over the operations of your company

Angel investors have business acumen, seek personal opportunities and take a long-term view

Receives a share of the profits.

E) Bank loans

Startup loans is a relatively new service that banks offer. Just like applying for home loans and consumer durables loans you can get a loan for funding your startup. Start-up loans are subject to terms and conditions that you must fulfill. Loan eligibility depends on collateral given as security. In some cases, you may require a guarantor (director, promoter, business partners) to co-sign loan documents if you don’t have credit history.

Startup loans is a relatively new service that banks offer. Just like applying for home loans and consumer durables loans you can get a loan for funding your startup. Start-up loans are subject to terms and conditions that you must fulfill. Loan eligibility depends on collateral given as security. In some cases, you may require a guarantor (director, promoter, business partners) to co-sign loan documents if you don’t have credit history.

Plus Points

Minus Points

Retain ownership of business and enjoy full profit margins

Tough eligibility qualification criteria with collateral requirements

Full access to as much funds as needed

Some loans can restrict cash flow

Commercial lenders are only interested in debt repayment not your profit lines

Lenders rates are dependent on government policy and market conditions. Fluctuating rates can inhibit revenue growth.

F) Local SMB development centers

These are centers that give you extra know-how and assistance in financing, marketing, and business operations. The Ministry of Skill Development & Entrepreneurship has partnered with 58 institutions across 12 states.

These are centers that give you extra know-how and assistance in financing, marketing, and business operations. The Ministry of Skill Development & Entrepreneurship has partnered with 58 institutions across 12 states.

Plus Points

Minus Points

You have access to other business building initiatives like workshops, panel discussions.

Competitive, rigorous application process

Provides expertise, mentorship and capital

Requires a time commitment of at least two years and adherence to preset schedule

Offers administrative support, production equipment, and a structured environment to help business keep focus.

G) Profit sharing investors

You could also approach investors who invest in startups based on a profit-sharing agreement. Their focus lies in distributions and reap returns when that startup generates profits. Profit share is that part of a company’s income that goes to the owner and investors. Profit shares come from business operations results.

You could also approach investors who invest in startups based on a profit-sharing agreement. Their focus lies in distributions and reap returns when that startup generates profits. Profit share is that part of a company’s income that goes to the owner and investors. Profit shares come from business operations results.

Plus Points

Minus Points

Investors accept risk and financial loss in case of business failure there’s no repayment responsibility.

Dividend payment dilutes your earnings shares.

Don’t require a proven credit history.

In exchange for taking on more risk, investors demand exceptional performance.

You gain extra expertise from these investors

Some loss of control as you are accountable to multiple investors.

Leveraging various funding methods

You can choose the right startup funding methods based on the kind of startup you have, the funds required and your credit history. To make this choice easier for you, we’ve simplified the funding methods and who they are suitable for.

Startup Funding Mode

Who is this for

Bootstrapping

A) For entrepreneurs who don’t have capital or social networks.

B) They have ample funds stored in bank accounts.

C) They have artistic direction and ownership control.

B) They have ample funds stored in bank accounts.

C) They have artistic direction and ownership control.

Financial aid from business/personal contacts

A) For entrepreneurs who require capital for small investments.

B) They have a big social network.

C) They have purchased saleable assets and don’t have much risk.

B) They have a big social network.

C) They have purchased saleable assets and don’t have much risk.

Crowdfunding

A) For entrepreneurs who have strong online social networks.

B) They are making products/services for the online community.

C) They wish to be comfortable with various types of funders, lenders, owners etc.

B) They are making products/services for the online community.

C) They wish to be comfortable with various types of funders, lenders, owners etc.

Angel Investors

A) For entrepreneurs with a proven finished product or business plan.

B) They want a better understanding of the market.

C) They wish to convert to venture capitalist methods in the future.

B) They want a better understanding of the market.

C) They wish to convert to venture capitalist methods in the future.

Bank Loans

A) For entrepreneurs with good credit.

B) They have past successful businesses.

C) They wish to remain in control and enjoy stability.

B) They have past successful businesses.

C) They wish to remain in control and enjoy stability.

Local SMB development centers

A) For entrepreneurs who want to improve their skills.

B) They want access to other benefits included with funding.

C) They have little business acumen and competitive advantage.

B) They want access to other benefits included with funding.

C) They have little business acumen and competitive advantage.

Profit Sharing investors

A) For entrepreneurs with no credit history

B) They have a good business plan/product that will work.

C) They are fine with shared ownership and profit sharing.

B) They have a good business plan/product that will work.

C) They are fine with shared ownership and profit sharing.

Once you have your entire funding ready, it is time to choose your online marketplace. See how selling on Amazon can work for you. Register now to find out.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Small Business Resources

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Share the knowledge of Bizzopedia

Article Categories

Amazon Programs for SMBs

© 2024 Amazon.in, Inc. or its affiliates. All rights reserved.