GST Overview

The Goods and Services tax or the GST came into effect from July 2017. GST is a value-added tax that is levied at the point of consumption rather than production. The end consumer bears this tax as the last person in the supply chain. This tax simplifies the indirect tax structure both at the Center and at the State levels, replacing the multiple layers of complex taxation seen in the VAT era. In the last 3 years after its launch, the Ministry of Finance, Government of India, considers the GST to be the single largest source of revenue for indirect taxes in India.

Despite the pandemic, the gross revenue in October 2020 was Rs 1,05,155 crore that is 10 per cent higher than the revenues earned in October 2019. Since Small and Medium Enterprises (SMEs) form a large constituent of economic activity in India, it remains critical to understand how these can avail of the benefits of Goods and Services Tax or the GST.

Despite the pandemic, the gross revenue in October 2020 was Rs 1,05,155 crore that is 10 per cent higher than the revenues earned in October 2019. Since Small and Medium Enterprises (SMEs) form a large constituent of economic activity in India, it remains critical to understand how these can avail of the benefits of Goods and Services Tax or the GST.

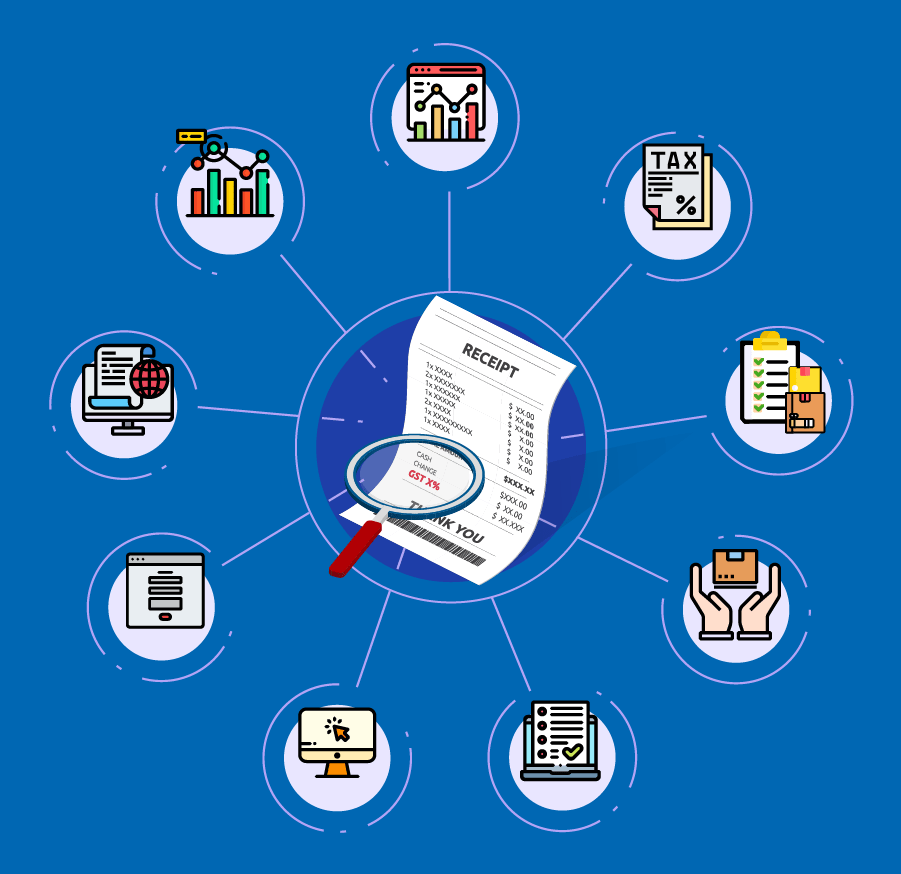

Advantages of GST Registration for Small and Medium Businesses

There are several benefits of GST registration for small and medium businesses or SMBs interested in expanding business opportunities. Let us look at these for SMEs like you.

- Launching a New Business becomes Easier: In the previous tax regime, popularly known as VAT or the value-added tax system, small businesses which had operations spread over multiple states had to register separately for paying tax at each of the state’s sales department. These separate and individual taxes based on the state’s tax structure complicated the entire business scenario. With GST registration, the process is centralized and the rules are uniform across the States. As a small business owner, you need to submit an online form to obtain a GSTIN or a GST identification number. You can start your business with relatively less formalities.

- Easy and Simple Tax Structure: As an SME, you can register for GST easily by avoiding an overlap of central and state taxes. The GST is a uniform tax on goods and services and merges the separate purchase taxes, luxury taxes and the VAT. You can also file a common return under the new regime at the GSTN portal. Since the filing of returns is online, it may be easier and less time consuming for business owners like you. A combined tax also means dealing with fewer tax authorities.

- Reduced Logistics Expenditure: The old regime under the VAT created many hassles for the small business owners transporting goods from one State to another. There were long queues at checkpoints and inter-state taxes that added on to labor and fuel costs. Delay in delivery of goods was also a bottleneck. Under the GST regime, the removal of border and check-post taxes makes delays and transportation costs outdated. This increases inter-state business, facilitates commerce by reducing maintenance costs.

- Distinction between Goods and Services has been removed: Previously, small businesses offering both goods and services had to pay service taxes individually. GST eases the process by removing the distinction between services and goods. Tax is calculated for the final total and not individual products and services. Small and medium businesses can then take advantage of the streamlined tax structure for payment and procurement of input goods and services such as import, interstate and local purchases. Small businesses also find the process of invoicing much simpler as only one tax rate for goods and services need to be mentioned.

- Increased Threshold Limits for GST Registration: In the VAT regime, businesses with an annual turnover of Rs 5 Lakh had to pay taxes while those in some states with Rs 10 lakhs as turnover made payments. Under GST, this tax burden is eliminated for small businesses since an entrepreneur does not have to pay if its annual turnover is less than Rs 20 lakh (Rs 10 lakh in Northeastern states). Under the composition scheme, businesses that have a turnover between Rs 20 to Rs 50 lakh will pay GST at a lower rate. This is a positive influence on small business owners who want tax-relief.

- Leveraging benefits of going Online: Thanks to the online system of registration and the benefits of GST to consumers, filing of returns has helped facilitate more small businesses to comply with tax mandates. A robust online portal enables small business owners’ flexibility and freedom as consumers and taxpayers. In addition, critical payments can be paid online making compliance easy for SMEs.

- More Transparency by taking care of Complications: Since frauds and tax avoidance were critical flaws in the VAT regime, the government made GST more multi-dimensional and transparent with a technology-centric focus. Since the taxes are simple and straightforward, there are no ambiguities for the small business owner. Future tax complications are avoided as revenues are steadily generated in a seamless online taxation system.

- Digitization gives more scope to Expand: The implementation of GST brings in an era of digitization that has spread supplemental benefits of GST registration. Since paperwork is removed and more accounting is done online, the chances of error have reduced. This has facilitated an ecosystem of growth and efficiency among business owners.

- Access to Markets across India: With a common tax across states, small business owners can avoid complex transaction processes to access markets at no further costs. The GST enables small producers to transact business nationally and create a pan-India footprint.

As per announcements of the Central Government, the definition of businesses that fall under the category of micro, small and medium enterprise or MSME has been changed to offer relief measures due to the pandemic. This change in the threshold of investment and turnover for businesses may allow them to grow and expand in the country. While there may be some hiccups on the road to realizing an indirect tax revolution in the country, the benefits of the Good and Services tax or GST remains undeniable.

Disclaimer: This blog is provided on a best-effort basis and suggests ways to enhance your business, and there is no assurance as to its accuracy, completeness or usefulness or that such information is error-free. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. You may decide either to accept or reject these suggestions in your sole discretion. Implementation of these suggestions may be subject to applicable laws. Please contact your consultants to understand your obligations and compliance under the applicable laws. You expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against [Insert the full name of the company which will host this blog] and/or its affiliates arising out of or in connection with the use of or reliance upon such information.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Guide to GST & Taxes

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Want to tell your loved ones about the blogs on Bizzopedia?

Use the links given below to share this on your social media

Use the links given below to share this on your social media

© 2021 Amazon.com, Inc. or its affiliates. All rights reserved