Why is it Helpful for SMBs to have Legal Knowledge?

Setting up a small business is a dream for many but achieved only by a few. Often, changing this dream into reality comes with a lot of responsibilities and complexities. Most of these issues arise as many start their seller journey without much preparation; they fail to realize that setting up a business is not limited to merely selling products and services to their customers. Existing business owners as well as those starting afresh may need to carefully consider several other background elements. This can help ensure that their business will be more profitable and have a long-term vision.

So understanding the basics of business finance, tax, and accounting laws is one element that business owners should not ideally ignore. You may wonder why, but the reason behind this is quite simple. Being aware of such laws ensures that business leaders operate legally in the country and act in a responsible manner. Complying with the applicable legal framework can also protect businesses from fines, lawsuits, audits, and issues regarding workplace safety, hiring, wages, and more.

So understanding the basics of business finance, tax, and accounting laws is one element that business owners should not ideally ignore. You may wonder why, but the reason behind this is quite simple. Being aware of such laws ensures that business leaders operate legally in the country and act in a responsible manner. Complying with the applicable legal framework can also protect businesses from fines, lawsuits, audits, and issues regarding workplace safety, hiring, wages, and more.

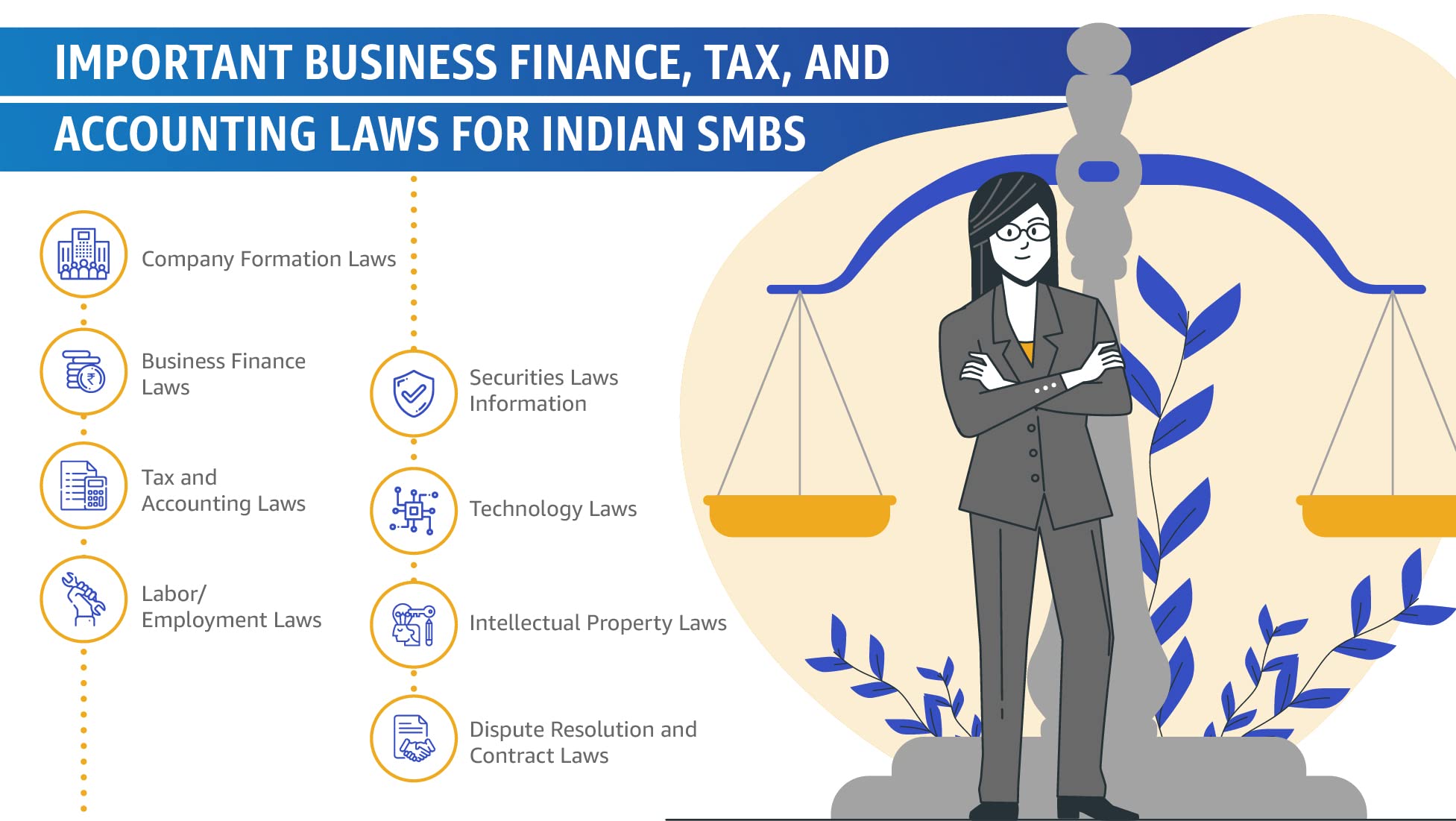

Important Business Finance, Tax, and Accounting Laws for Indian SMBs

Here is a basic overview of the most important business finance, tax, and accounting laws that can help you run a successful and ethical business in India:

Company Formation Laws

Before starting your business in India, you need to choose your company structure. In simple words, you need to decide the type of company you want to own – a limited liability enterprise, a sole proprietorship, or something else. Then you need to fulfil the various pre- and post-incorporation requirements relevant for that company type as stated under the Indian Companies Act, 2013. The most important requirement is of course registering your company with the regional Registrar of Companies.

Business Finance Laws

Small business usually can rely on three types of funding-

- Equity financing – where investors buy your company’s shares.

- Debt financing – where you take loans for your business from private moneylenders or commercial and government banks.

- Self-financing – where you invest personal resources into your business.

If you are relying on equity funding, you will need to comply with the guidelines set by the Security and Exchange Board of India (SEBI), the Companies Act, 2013 and the RBI. Some of the important documents needed for equity financing are shareholders agreement, share subscription agreement, and letter of intent.

For debt financing, you can apply for an MSME loan online and submit all the required ID and financial documents. You can also borrow money from private moneylenders if needed. Click here to know more about ways to obtain funding for your startup.

- Equity financing – where investors buy your company’s shares.

- Debt financing – where you take loans for your business from private moneylenders or commercial and government banks.

- Self-financing – where you invest personal resources into your business.

If you are relying on equity funding, you will need to comply with the guidelines set by the Security and Exchange Board of India (SEBI), the Companies Act, 2013 and the RBI. Some of the important documents needed for equity financing are shareholders agreement, share subscription agreement, and letter of intent.

For debt financing, you can apply for an MSME loan online and submit all the required ID and financial documents. You can also borrow money from private moneylenders if needed. Click here to know more about ways to obtain funding for your startup.

Tax and Accounting Laws

The Income Tax Act, 1961 states that businesses in India need to timely file their taxes and obtain their TAN (Tax Account Number). This number needs to be mentioned in TDS/ TCS return, challan and certificates (including e-TDS/ TCS).

TDS (Tax Deducted at Source) is aimed to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount based on Form 26AS or the TDS certificate issued by the deductor. On the other hand, TCS (Tax Collected at Source [2]) refers to the tax payable by a seller, which he collects from the buyer at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers. SMBs can enjoy several benefits by timely filing their taxes.

Another tax law to be aware of is the recently introduced GST (Goods and Services Tax, 2017). As per Government of India regulation, if the annual turnover of your business exceeds the set turnover limit under the GST rule (INR 40 lakhs for normal category states and INR 20 lakhs for special category states), you need to mandatorily register for GST. To know more about the eligibility criteria for GST registration, click here. However, this tax is not applicable if you deal in goods or services listed under the GST-exempted category. Click here to know all about GST and GST registration in India.

TDS (Tax Deducted at Source) is aimed to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount based on Form 26AS or the TDS certificate issued by the deductor. On the other hand, TCS (Tax Collected at Source [2]) refers to the tax payable by a seller, which he collects from the buyer at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers. SMBs can enjoy several benefits by timely filing their taxes.

Another tax law to be aware of is the recently introduced GST (Goods and Services Tax, 2017). As per Government of India regulation, if the annual turnover of your business exceeds the set turnover limit under the GST rule (INR 40 lakhs for normal category states and INR 20 lakhs for special category states), you need to mandatorily register for GST. To know more about the eligibility criteria for GST registration, click here. However, this tax is not applicable if you deal in goods or services listed under the GST-exempted category. Click here to know all about GST and GST registration in India.

Labor/Employment Laws

Labor and employment laws safeguard the interests of all employees. If you are planning to hire employees or presently have people working for you, you will need to abide by the extant Employment and Labor Laws of India as well as the recent reform initiatives undertaken by the Central and State Governments.

Securities Laws

The Indian Parliament has brought into effect the SEBI (Securities and Exchange Board of India) Act in 1992.. Various regulations have been introduced with time to regulate the stock exchange and prevent any fraudulent activities related to the same.

Information Technology Laws

The Information Technology Act, 2000 was introduced with the objective to reduce cyber crimes like data theft, identity theft, cheating by impersonation, and hacking in India. With significant small and medium businesses starting to shift their stores online, India had 330 million online buyers and 700 million internet users in 2020. So these regulations aim to not only safeguard online businesses, but also strive to protect every internet user from cybercrimes.

Intellectual Property Laws

If your business provides a unique product or service, you will need to use copyright, patent, or a trademark to prevent others from using it without your permission. The Copyright Act, 1957; the Trade Marks Act, 1999; the Patents Act, 1970 and the Designs Act, 2000 are India’s intellectual property laws. These aim to prevent intellectual property theft and can boost your profitability via royalties.

Dispute Resolution and Contract Laws

Your business in most cases survives on contracts. Business owners often need to sign agreements with their partners, clients, and service providers. The Arbitration and Conciliation Act, 1996 provides a mechanism to resolve any dispute or disagreement arising out of contracts, as an alternative to the conventional judicial process This can help business owners to protect their business,run it smoothly, and settle disputes amicably.

So all these business finance, tax, and accounting laws have been drafted to safeguard the interests of business owners, along with their customers and employees. It is advisable to comply with these regulations to avoid legal or penal consequences and uphold the value of true leadership.

So all these business finance, tax, and accounting laws have been drafted to safeguard the interests of business owners, along with their customers and employees. It is advisable to comply with these regulations to avoid legal or penal consequences and uphold the value of true leadership.

Disclaimer: This blog is provided on a best-effort basis and suggests ways to enhance your business, and there is no assurance as to its accuracy, completeness or usefulness or that such information is error-free. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. You may decide either to accept or reject these suggestions in your sole discretion. Implementation of these suggestions may be subject to applicable laws. Please contact your consultants to understand your obligations and compliance under the applicable laws. You expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon and/or its affiliates arising out of or in connection with the use of or reliance upon such information.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Small Business Schemes

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Share the knowledge of Bizzopedia

Article Categories

Amazon Programs for SMBs

© 2024 Amazon.in, Inc. or its affiliates. All rights reserved.