What is Working Capital?

Working capital or the Net Working Capital (NWC) is the capital used to meet the day-to-day trading operations of a company. It is calculated as the difference between current assets (e.g. cash accounts receivable) and current liabilities (e.g. accounts payable).

- If the ratio of current assets to liabilities is less than one, then the company has a negative working capital. This indicates that the company might face difficulties in growing or paying back its creditors. In the worst case scenario, the company can even go bankrupt if the current assets continuously fail to exceed the current liabilities.

- If the ratio of current assets to liabilities is greater than one, then the company has a positive working capital. This indicates that the company can bear the expenses of its current expenditures and can invest in future activities and projects. Thus, it is crucial for companies to maintain a positive working capital.

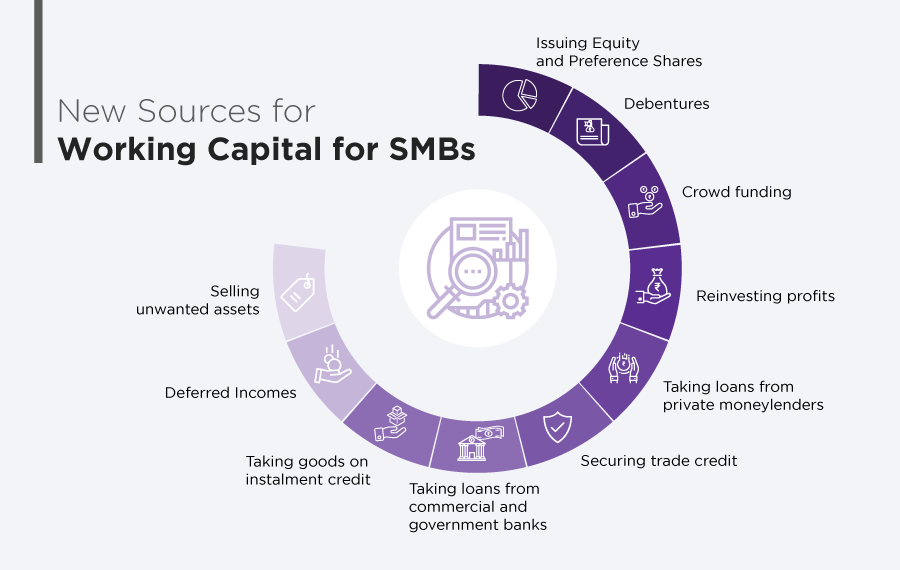

New Sources for Working Capital for SMBs

Companies may maintain a positive working capital if they have access to multiple reliable funding sources. Here are a few of such sources that could help you meet your working capital requirements:

1. Issuing Shares (Equity and Preference Shares)

One of the most common methods to raise long-term funds for your business is issuing shares. This funding method is trusted and used by most of the companies. Shares are units of fixed value of the company’s capital that are issued to shareholders who receive a dividend in return for their investment in the company. Preference shares and equity shares are the two types of commonly issued shares. Here are few features of issuing preference shares:

- No obligation to pay dividend as dividend is only payable if there are visible profits

- It serves as a permanent capital source for the company

- No need to create extra charge on the company’s assets

- Allows flexible repayment of capital in case of surplus funds

- Since the shareholders do not carry any voting right, they have no say in dilution of control

- Cannot be considered as a deductible expense

- Becomes a permanent burden so far as the payment of dividend is concerned

- An expensive source of finance if compared to other funding solutions, such as debentures

Features of equity shares:

- No obligation to pay a fixed dividend to shareholders

- Can help strengthen the company’s financial base

- Allows inclusion of members since individual shares have a small face value

- Shareholders can vote in matters that require consent of shareholders

- Can assist in capital formation since they serve as a permanent source of income

- Uncertainty of return can demotivate investors

2. Debentures

Companies issue debentures as an evidence of any debt that is due from the company. Here are a few features of debentures:

- Can provide funds to the company for a longer duration

- Enables company to leverage equity shares in a better way

- Lower interest rates than dividend payable on shares

- Helps reduce tax burden as interest on debentures is a tax deductible expense

- No risk of control dilution since holders do not have voting rights

- Can be easily redeemed by company when the funds are surplus

- Can turn out to be a permanent burden on the company as interest rates are fixed

- Heavy stamp duty increases the cost of raising debentures

- Not a suitable mode of funding for companies with unstable incomes

3. Crowd Funding

Crowd funding is a fund-raising method that allows the public to deposit funds for the companies. Here are a few features of crowd funding:

- Can serve as a cheaper method of fund-raising for shorter terms

- Follows a very simple and convenient method

- Does not require creation of any charge on assets

- Fixed interest rates and maturity period allows taking advantage of trading on equity

- Limited funds can be sourced

- Unreliable source of finance

- Shorter maturity periods

4. Reinvesting Profits

Reinvesting profits is a technique used by companies that involves retaining a certain amount of profits for reinvesting them back in the company. Here are a few features:

- Economical funding option since it does not involve any extra expenditure

- Reduces uncertainty and ensures flexibility because the company is not dependent on any outside source for raising the fund

- Enables a stable dividend policy

- Helps redeem long-term debentures and loans

- Can deprive shareholders of their freedom to reinvest in better opportunities

5. Taking Loans from Private Moneylenders

Private moneylenders or indigenous bankers have been serving as the one of the sources of finance for generations in our country. While the rise of commercial banks may have somewhat overshadowed these moneylenders, they can still serve as a funding solution for meeting short-term requirements.

6. Securing Trade Credit

Securing trade credit refers to taking goods or other needed materials from suppliers on credit. This mode of funding for working capital can serve as an important source of short-term finance. Since it provides interest-free capital, this funding method can be leveraged efficiently by businesses to gain maximum benefit out of it. However, since credit worthiness and goodwill forms the basis of this arrangement, it can at times turn out to be unreliable.

7. Taking Loans from Commercial and Government Banks

Commercial and government banks are now the main funding source for a lot of companies to secure capital. Banks provide an advance in return for security, to companies for their business growth, subject to special requirements of every bank. You may avail this facility and solve your funding requirements by applying for loans, cash credit, overdrafts and discounting bill of exchange. You can also make use of government initiatives and schemes that are launched and are in action, and that you are eligible for to provide funding solutions for small and medium businesses.

8. Taking goods from suppliers on Instalment credit

In this method, goods are secured in advance but payments are cleared later in instalments. Usually, an interest rate is charged on the unpaid amount for a predetermined period of time.

9. Taking an Advance from Clients (Deferred Incomes)

Companies can also take an advance payment (deferred incomes) from their clients before completing the order. This can easily help them cover their day-to-day expenses and serve as a short-term financing solution.

10. Selling Unwanted Assets

Another way of raising funds for maintaining a positive working capital is to sell off unwanted capital assets to meet bigger financial needs. The only drawback of this method of securing funds is that you can no longer enjoy the benefits that were being provided by those assets.

Conclusion

There are numerous financial funding solutions to maintain your working capital requirements. All that you need to do is choose the most suited one and further your business journey.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Small Business Schemes

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Share the knowledge of Bizzopedia

Article Categories

Amazon Programs for SMBs

© 2024 Amazon.in, Inc. or its affiliates. All rights reserved.