Knowing the ins and outs of your cash flow is essential for any business. An understanding of where your funds go and come from is essential to create and maintain a profitable organization. However, this process can sometimes feel incredibly daunting and complex for many business owners.

The process to balance your books and keep your financial reports in order usually consists of two key steps- bookkeeping and accounting. Though they may seem like similar terms, they are two distinct parts in a collective whole that help business owners stay on top of their funds.

Firstly, bookkeeping is a process that refers to keeping track of all the expenditures made by your company, such as sales, payments, purchases, etc. Through a variety of different bookkeeping methods organizations can note down every penny that has been spent in running a business.

Accounting however, is the process of taking all the data recorded by bookkeepers and using it to see if the business is operating efficiently. Accountants tabulate data from financial reports and balance sheets and analyze them to create a clear picture of the organization’s monetary usage. In the simplest of terms, the bookkeeper records the expenditure details in their reports while the accountant uses those reports to tell the company how well they are operating.

Even though small business owners represent 99% of businesses globally, only about 67% of them are satisfied with their accounting services. Many business owners are wary of outsourcing their accounting jobs. However, the digital era has opened up avenues where businesses can choose to use free accounting programs to complete their accounting tasks whilst maintaining full ownership over their financial matters.

The process to balance your books and keep your financial reports in order usually consists of two key steps- bookkeeping and accounting. Though they may seem like similar terms, they are two distinct parts in a collective whole that help business owners stay on top of their funds.

Firstly, bookkeeping is a process that refers to keeping track of all the expenditures made by your company, such as sales, payments, purchases, etc. Through a variety of different bookkeeping methods organizations can note down every penny that has been spent in running a business.

Accounting however, is the process of taking all the data recorded by bookkeepers and using it to see if the business is operating efficiently. Accountants tabulate data from financial reports and balance sheets and analyze them to create a clear picture of the organization’s monetary usage. In the simplest of terms, the bookkeeper records the expenditure details in their reports while the accountant uses those reports to tell the company how well they are operating.

Even though small business owners represent 99% of businesses globally, only about 67% of them are satisfied with their accounting services. Many business owners are wary of outsourcing their accounting jobs. However, the digital era has opened up avenues where businesses can choose to use free accounting programs to complete their accounting tasks whilst maintaining full ownership over their financial matters.

What Accounting Means for Small Businesses

For small businesses, accounting usually consists of tracking all kinds of expenses and payments based on reports from bookkeeping, along with requisite proof of payments such as bank and credit card statements. Accountants to build a framework for an organization’s financial infrastructure also use tax returns from previous years, lease agreements and other similar forms. In this ecosystem, often the role of bookkeeper and accountant is the same – with the same person conducting both tasks as part of their overall job.

Nowadays, small businesses can leverage a variety of accounting methods depending on their size, income and tech-savviness to do their work for them. A few prominent accounting methods that small businesses may choose to leverage are –

Nowadays, small businesses can leverage a variety of accounting methods depending on their size, income and tech-savviness to do their work for them. A few prominent accounting methods that small businesses may choose to leverage are –

- 1. Doing their accounting themselves with the help of specialized software

- 2. Outsourcing their work to a Chartered Personal Accountant (CPA)

- 3. Hiring an internal accountant for their business

In many cases, business owners may be able to handle accounting on their own. Certain software makes the process easier by completely automating the entire process as well as ensuring that proper bookkeeping methods and cash flow statements are maintained. However, some business managers may inevitably feel overwhelmed and can resort to looking for professional accountants or outsourcing the work to external experts.

Digital Accounting – A New Frontier

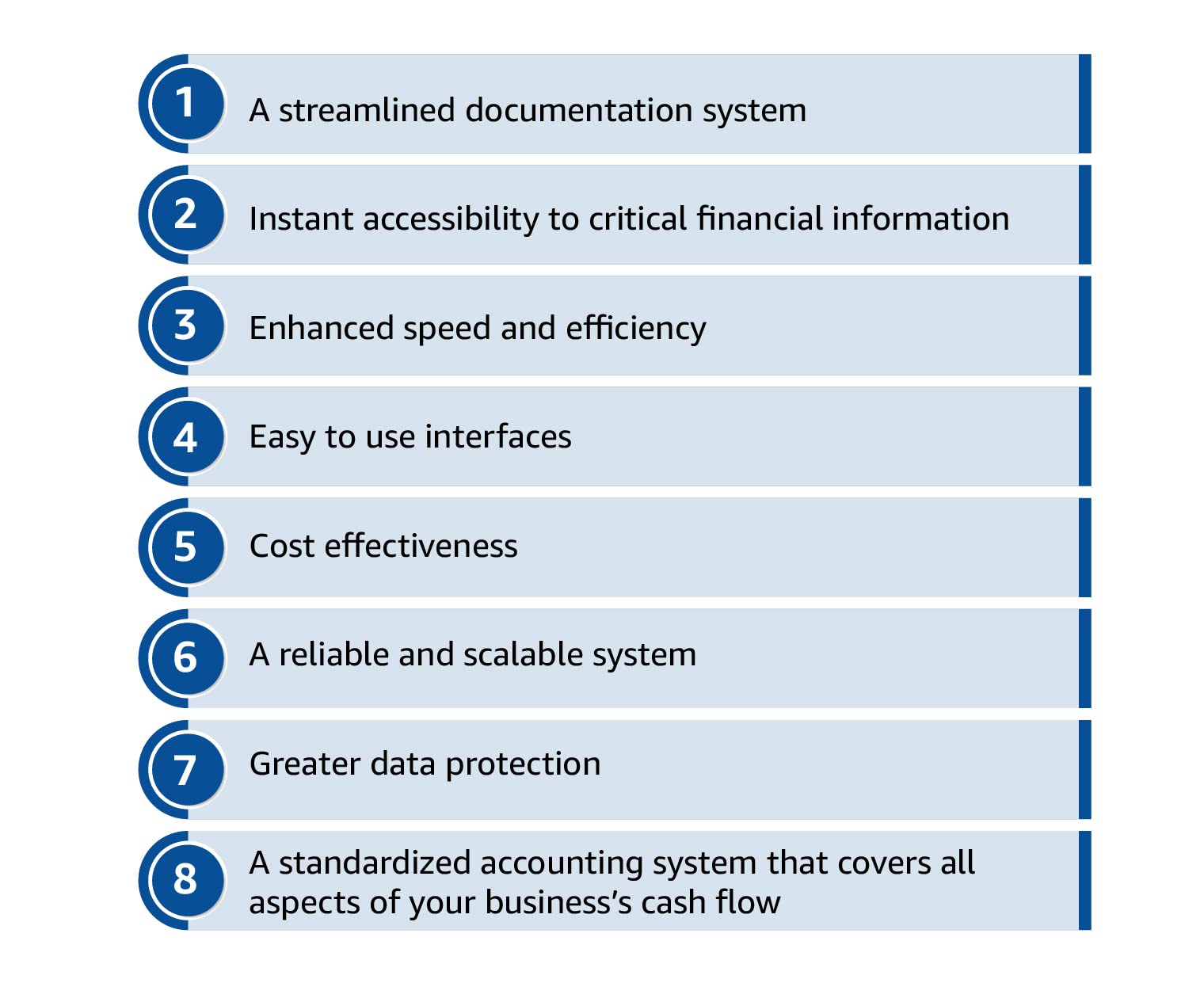

Regardless of the methods, the benefits of accounting as a whole should not be taken for granted. For small businesses in particular, the primary benefits of maintaining digital accounting include –

- 1. A streamlined documentation system

- 2. Instant accessibility to critical financial information

- 3. Enhanced speed and efficiency

- 4. Easy to use interfaces

- 5. Cost effectiveness

- 6. A reliable and scalable system

- 7. Greater data protection

- 8. A standardized accounting system that covers all aspects of your business’s cash flow

For those businesses that have more confidence in self-accounting, the digital age opens up many new avenues for them to use software that makes the task that much easier. Especially when concerns of mismanagement or loss of data worries so many, digital accounting software ensures that all data is kept handy at a moment’s notice. More importantly, by digitizing their efforts, businesses can focus more on all the other aspects of their business – thus saving time in the process. With over 82% of small businesses using some form of accounting software or the other (on-site or cloud-based), the trend of leveraging digital solutions is poised to become a key part of the basics of small business.

Looking Towards the Future

With all these factors in mind and the benefits laid out ahead, if you are a small business, you may already be looking at various accounting software options on the internet. With so many to choose from, it might seem intimidating at first – which is why it is vital that you make your decisions in accordance with your needs.

- Support: Firstly, you’ll want to choose a digital solution that has reliable support services. Services with good resources and on-hand support can be a blessing and save you valuable time while learning the nitty-gritty of the software.

- Pricing: This is also an important consideration. Several accounting platforms need expensive add-ons, or charge percentage based payments for continued use of their services. As a small business, it is important to have a detailed understanding of what you’re getting into pricewise. Whether it is a flat out payment for using the software or incremental ones down the line, being aware of the actual costs with any given accounting platform is important.

- Future proofing: Finally, choosing a platform that is scalable is of utmost importance too. The same way in which you look at your business as an entity that will see growth, you will need digital solutions that grow with you. By making the right choices, you can ensure that your accounting software supports your business growth as it moves forward.

The digital age is primed with opportunities that can be leveraged by small businesses. With a host of accounting software on the market, the options are truly limitless for your business. All that is left is for you to make your choices and hoist your business to new heights. All this with a more streamlined cash flow framework while balancing the books.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Small Business Schemes

Signup for our newsletter and get notified when we publish new articles for free directly into your inbox.

Browse Bizzopedia by Category

Get the latest updates on all things business

Share you information to subscribe and get updates on business guides, trends, tips

Share the knowledge of Bizzopedia

Article Categories

Amazon Programs for SMBs

© 2024 Amazon.in, Inc. or its affiliates. All rights reserved.